Can Intel Serve Two Masters?

This week I interviewed Pat Gelsinger, the chief executive of Intel, which is one of the most important companies in the United States. President Biden seems to think it’s singularly important, anyway: His administration has tentatively agreed to give Intel $8.5 billion in grants and $11 billion in low-cost loans to help it push ahead in computer chip design and manufacturing. It should also qualify for about $25 billion in investment tax credits.

To Biden and Commerce Secretary Gina Raimondo, the special thing about Intel is that it doesn’t just design chips in the United States, as, for example, the current stock market darling Nvidia does. It manufactures them domestically as well. It’s planning to spend $100 billion over five years on manufacturing and research and development projects in Arizona, New Mexico, Ohio and Oregon.

The Biden administration believes semiconductors are a key to the future, so allowing their manufacture to move almost entirely offshore would jeopardize America’s national security and economic leadership. “Leading-edge logic chips are essential to the world’s most advanced technologies like artificial intelligence, and this proposed funding would help ensure more of those chips are developed and made domestically,” the Commerce Department said last week in its announcement of the incentives for Intel.

In chip-making, Intel goes up against T.S.M.C. of Taiwan, Samsung of South Korea, and GlobalFoundries, which is majority owned by an investor based in Abu Dhabi. While all three of those rivals have some U.S. production, Intel is the only one that has U.S. headquarters and its most advanced production and process technology R & D in the United States. Raimondo, at the announcement in Arizona, called Intel “America’s champion semiconductor company.”

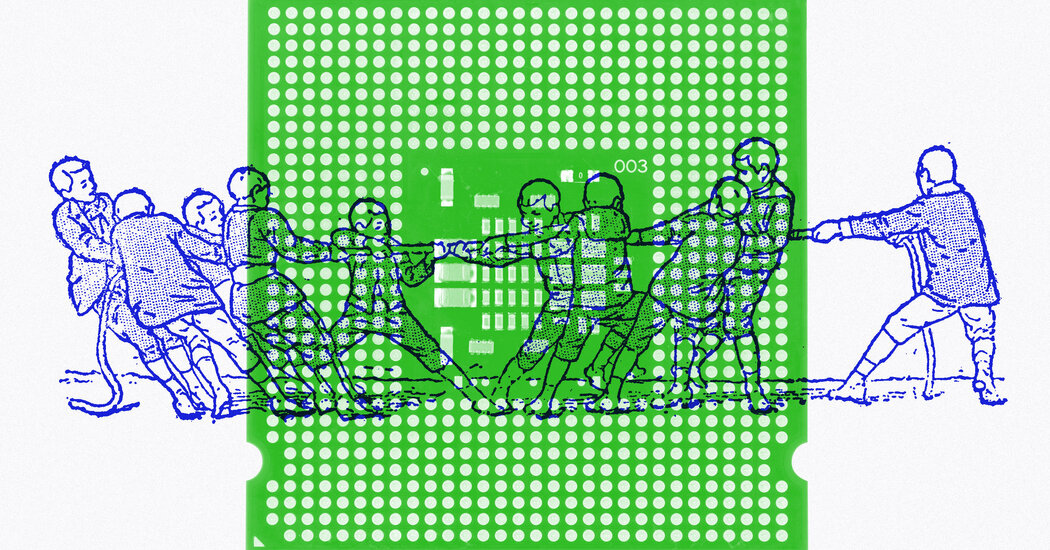

For Gelsinger, being unofficially named a national champion brings complications. The money is nice, but it comes with strings attached. All C.E.O.s of public companies work for their shareholders; Gelsinger has to do that, but also please the government. The money is released in tranches as Intel reaches the milestones that the government has set for it, such as construction of chip factories (“fabs”), training of workers and development of new products.

Wall Street isn’t sold on Gelsinger’s commitment to manufacturing, which is expensive and has an uncertain payoff: In October 2021, when Gelsinger announced the long-term financial impact of his manufacturing expansion, “Wall Street was stunned” and Intel lost $25 billion in market value, The Times reported. The company’s shares have fallen about 20 percent over the past five years, while shares are up more than 500 percent at Advanced Micro Devices and 1,800 percent at Nvidia, both of which are fabulously fabless, meaning other companies make their chips for them.