Philanthropy, the Billionaires’ Way

A favorite tax play by billionaires on the right and the left

The move by the Chouinard family to give away Patagonia, the $3 billion outdoor apparel company founded in the 1970s by Yvon Chouinard, to a special trust and a nonprofit grabbed headlines because it felt like a very un-billionaire-like way to fight climate change.

But tax experts have homed in on parallels between the green-minded Chouinard family and Barre Seid, the Republican billionaire who gifted $1.6 billion from the sale of his company to a conservative political action group. In each case, the donors appear to have avoided huge federal estate and gift taxes.

“From what I’ve seen, they’re doing the same thing,” Ray Madoff, a professor specializing in tax law at Boston College Law School, told DealBook. “The only difference is the politics.”

It’s all about the 501(c)(4). The Chouinards and Seid effectively donated their companies to 501(c)(4) organizations, which can make unlimited political donations. People who transfer assets to these organizations can’t take deductions from their income taxes, but they can avoid estate and gift taxes.

Unlike Seid, Chouinard, his wife and two adult children expect to pay some taxes: $17.5 million in gift taxes after donating Patagonia’s voting shares — 2 percent of its overall shares — to a separate trust. But Madoff calculates that Yvon Chouinard and his wife would have paid more than $1 billion in estate and gift taxes if they simply left Patagonia to their heirs. And a standard sale would of course have generated a huge tax bill, even if some of it was offset by subsequent donations. (Worth noting: Their children already owned an undisclosed amount of stock, so the estate tax could have been less, and the Chouinards explored other potential transactions that would have been taxable.)

Also unlike Seid, who sold his company as part of his donation, the Chouinards will keep control of theirs, thanks to their oversight of the voting shares trust.

And it’s all about the estate and gift taxes. Both donations avoided capital gains taxes, though there were other ways of doing so. More notably, they avoid estate and gift taxes, which come in at 40 percent. Such donations can minimize the tax hit that billionaires would otherwise pay on huge gifts and inheritances. Donating to 501(c)(4) groups is entirely legal — and its usefulness in avoiding gift and estate taxes is growing in popularity across the political spectrum.

At this point, those taxes have “been so delegitimated that people don’t recognize them as a real tax,” Madoff said.

For his part, Yvon Chouinard told The Times he wanted to secure the future of both Patagonia and its contributions to environmental causes. He also, quite simply, didn’t want to remain a billionaire. “For us, this was the ideal solution,” he said.

But Madoff views these gifts as a failure of government policy. “We are letting people opt out of the support of the government that the rest of us have to participate in,” she said.

HERE’S WHAT’S HAPPENING

FedEx expects rough times ahead. The delivery giant slashed its earnings forecast and said it would reduce flights and freeze hiring, after reporting disappointing preliminary quarterly results. Its C.E.O., Raj Subramaniam, said he expects a global recession. FedEx shares tumbled nearly 20 percent in premarket trading.

Uber gets hacked. The ride-hailing company appeared to suffer a wide-ranging breach that compromised many of its core internal resources, including source code. “They pretty much have full access,” a third-party security engineer said of the perpetrator.

Mortgage rates keep rising. Rates jumped above 6 percent this week, their highest level since the 2008 financial crisis and more than double where they were a year ago. Yet any cooling off of housing prices is likely to be small, given a lack of supply.

Roger Federer hangs up his racket. The Swiss tennis great announced his retirement from pro play, capping two decades of victories — and an estimated $1 billion in earnings, largely from endorsements and sponsorships. (The news is a reason to reread this wonderful appraisal of Federer by David Foster Wallace.)

TikTok’s mysterious C.E.O.

Like many of the viral videos on its platform, TikTok is being managed with some fancy choreography that obscures what’s really going on. The video app says it’s run by its C.E.O., Shou Zi Chew, a 39-year-old executive based in Singapore, and that its operations are separate from ByteDance, its Chinese parent company.

In fact, it appears that major decisions, from changes to its app to the company’s long-term strategic plan, are made by Zhang Yiming, ByteDance’s founder, and other executives from TikTok’s Beijing-based parent company, report The Times’s Ryan Mac and Chang Che.

TikTok’s efforts to hide its true leadership come amid rising tensions between the U.S. and China. Also growing are questions about how the company protects the data of its 1.6 billion users, and whether Chinese authorities can access it. Donald Trump, as president, threatened to shut down TikTok’s U.S. operations. Yesterday, President Biden signed an executive order clarifying the government’s ability to limit Chinese investment in U.S. tech.

Little is known about TikTok’s C.E.O. or how the company is run.

-

Chew, a former tech investor and C.F.O. of the Chinese device maker Xiaomi, became C.E.O. in May 2021.

-

He has shuttered expensive marketing efforts, including a celebrity-driven TikTok NFT campaign and a half-developed retail store in Los Angeles, and overseen the layoffs of North American employees.

-

He seems expendable. “If he didn’t want to do something ByteDance wants him to do, he could be fired,” said Salvatore Babones, the director of China and free societies at the Center for Independent Studies, an Australian think tank.

Crypto divisions hit D.C.

Crypto is the talk of Washington this week — and that has little to do with Merge mania. The White House today released a “comprehensive” framework for overseeing digital tokens, mandated by President Biden’s March executive order. Missing from the report were any clear timeline or specific rules and proposed legislation for how to regulate such assets. Yesterday, a pair of Senate hearings highlighted how a key regulatory question remains unresolved.

When is a token a security, and when is it a commodity? Senator Patrick Toomey of Pennsylvania, the top Republican on the banking committee, asked that question of the S.E.C. chair, Gary Gensler. The answer depends on how you interpret a 20th century Supreme Court ruling involving Florida orange grove investments. Interpretations vary widely. Gensler contends that the “vast majority” of crypto tokens are securities under that test. The C.F.T.C.’s chair, Rostin Behnam, took the opposite position yesterday.

One query, two very different hearings. While Gensler faced hard questions from Republicans, Behnam had an easier time when he appeared before the Senate agriculture committee. Lawmakers there are advancing a bipartisan bill that would give the C.F.T.C. jurisdiction over tokens defined as commodities. Behnam’s stance is that “most” crypto tokens are commodities. The “vast majority” vs. “most” debate is a bigger deal than it sounds. Crypto lobbyists fear it could further muddle the regulatory future of tokens.“The ‘digital commodity’ definition is too narrow and vague and must be clarified to draw a clear dividing line between the C.F.T.C. and S.E.C.,” said Jake Chervinsky, head of policy at the Blockchain Association, an industry trade group.

The White House is short on specifics.When questioned at a press briefing about the different positions held by the S.E.C. and C.F.T.C., one senior administration official said they were “in some ways competing,” but argued that both agencies already have the authority they need to police crypto. “I don’t think there’s a tension,” the official said.

“Stamps really don’t mean anything to Janet at all.”

— John Yellen, the brother of Treasury Secretary Janet Yellen, on how diplomats keep mistakenly thinking she is into stamp collecting. Hint: She much prefers rocks.

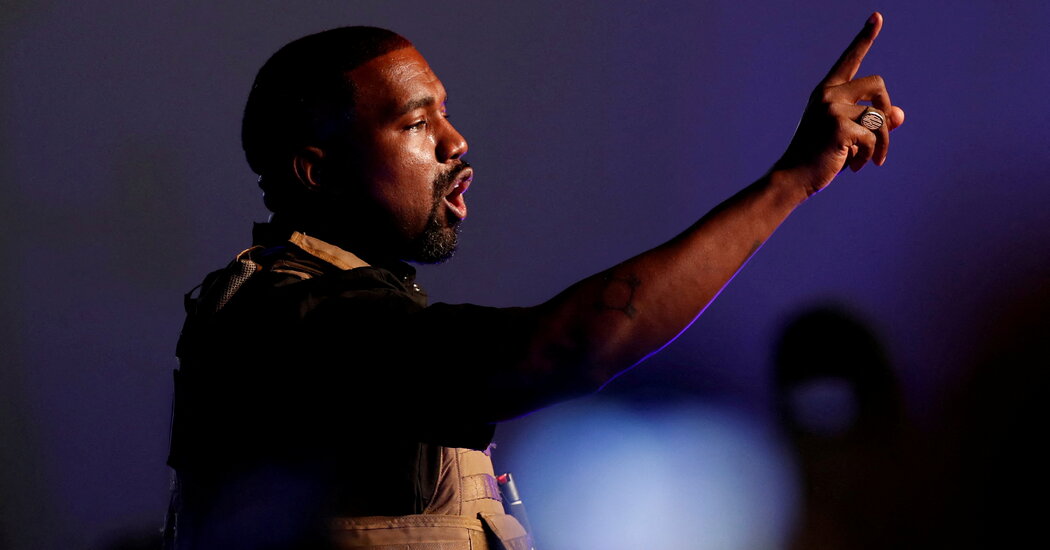

Kanye’s messy breakup with Gap

Credit…Randall Hill/Reuters

Kanye West’s weeks-long, Instagram-trolling breakup drama with Gap took a decisive turn yesterday. The rapper-turned-fashion-mogul, now known as Ye, notified the retailer that he was terminating their partnership. In a letter, which was viewed by DealBook, Ye’s lawyers said Gap had “abandoned its contractual obligations.” Their grievances: Gap didn’t do enough to sell his Yeezy products in Gap stores or open new retail locations dedicated to Yeezy merchandise.

In terminating the deal, Ye forfeits warrants for up to 8.5 million shares of Gap that, according to regulatory filings, were to vest based on sales targets. The deal was announced in 2020 to much fanfare, and was supposed to last 10 years. Gap had hoped that by year five, Yeezy Gap would generate $1 billion in annual sales.

What’s next for Gap? Business at the troubled retailer has slowed and the board is searching for a new C.E.O. after Sonia Syngal abruptly stepped down in July. (In its most recent quarter, Gap brand sales fell 10 percent year on year.) Gap faces big challenges in generating buzz for its products, Dana Telsey, the C.E.O. of the consultancy Telsey Advisory Group, told DealBook. Would Gap look for other big-name partnerships? “You would think so over time,” Telsey said. “But being able to get the brand stabilized, I would think, is the first priority.”

What about Adidas? Ye also has a 10-year deal with Adidas for his Yeezy line that is supposed to run through 2026. On Instagram, he’s expressed unhappiness with their partnership. In a since-deleted post, he said, “It’s going to cost you billions to keep me. It’s going to cost you billions to let me go.” In a Bloomberg interview earlier this week, Ye said it was “time for me to go it alone.”

THE SPEED READ

Deals

-

Adobe agreed to buy Figma, a collaboration software company, for $20 billion. It was a rare bit of good news for tech start-ups. (NYT, WSJ)

-

Apple and Amazon reportedly passed on bidding for streaming rights to LIV Golf, the Saudi-backed pro golf tour. (WSJ)

-

Britain’s new government will try again to convince SoftBank to list its chip design company Arm in London. (FT)

Policy

-

The C.F.P.B. plans to regulate “buy now, pay later” companies like Affirm and Klarna. (Reuters)

-

Debt investors are increasingly worried about Britain and its economic plans; also, the pound hit a 37-year low. (NYT, BBC)

-

Germany seized control of the German subsidiary of Russia’s Rosneft to shore up its energy reserves. (Reuters)

Best of the rest

-

Tesla executives are reportedly counting employees’ card-swipe entries in light of Elon Musk’s strict return-to-office policy. (CNBC)

-

Airlines are cracking down on carry-ons. Guess why. (WaPo)

-

Somehow, Gordon Gekko-esque contrast-collar dress shirts are back in style. (Robb Report)

Thanks for reading! We’ll see you tomorrow.

We’d like your feedback. Please email thoughts and suggestions to [email protected].

We’d like your feedback! Please email thoughts and suggestions to [email protected].